Tokenomics

Explore TFY's deflationary tokenomics with limited initial circulation and sustainable emission controls.

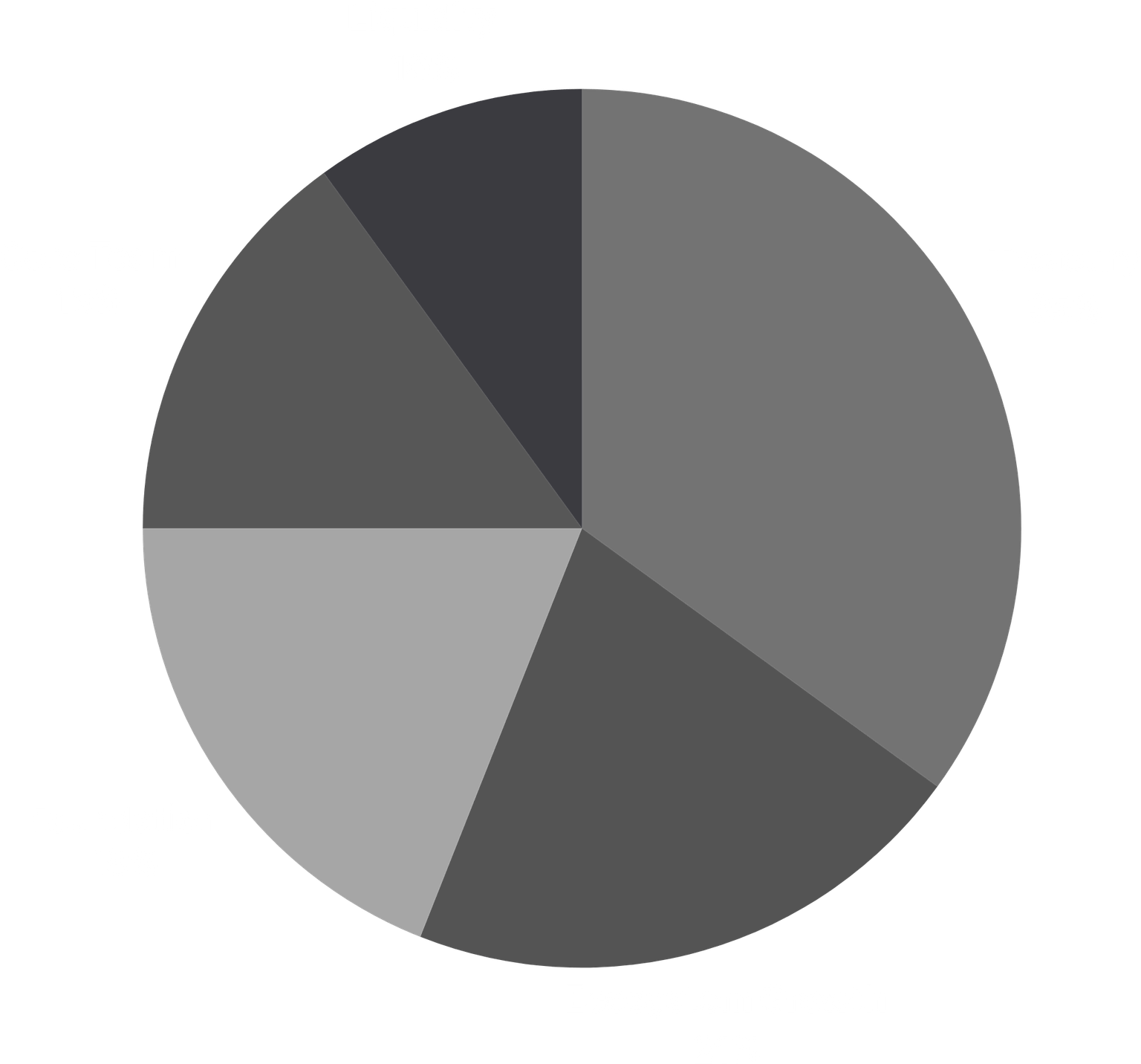

Thirdfy's o(3,3) protocol launches with a carefully structured token distribution—only 50M TFY enters initial circulation from a 500M total supply. Built on Base with multiple deflationary mechanisms including exit penalties and 90% of initial tokens locked in xTFY, the protocol ensures sustainable growth through controlled supply expansion.

Emissions

Initial Supply

500M TFY

Asymptotic Growth

xTFY emissions follow a smooth decay curve over approximately 500 epochs (~10 years), with ~1.2B xTFY distributed before weekly emissions fade to near zero. This controlled release ensures long-term sustainability while maintaining adequate rewards for ecosystem participants.

Weekly Emissions

Up to 2.88M TFY are available per epoch (0.192% of total supply); actual distributed emissions are flexed each epoch to maintain sustainability.

Emission Control

xTFY voters direct all emissions to gauges each week.

Emissions are the new xTFY tokens that Thirdfy distributes to reward active participants. These tokens are distributed weekly to various pools based on xTFY holder votes, creating ongoing incentives for liquidity providers and stakers in the ecosystem.

Launch Allocations

TFY Initial Distribution

Initial supply allocation of 500M TFY tokens

| Holder | Amount | % of Initial | Token Type |

|---|---|---|---|

| Treasury | 150M TFY | 30% | xTFY |

| AgentDrop | 105M TFY | 21% | xTFY |

| Foundation | 95M TFY | 19% | xTFY |

| Core Team | 100M TFY | 20% | xTFY |

| Liquidity | 50M TFY | 10% | TFY |

Only 50M TFY enters circulation immediately, with remaining tokens allocated as locked xTFY to ensure controlled distribution and sustainable growth.

Note: Treasury allocation includes 15M xTFY reserved for early community supporters in xTFY format.

Three-Token System

TFY

The base ecosystem token. Trade it, provide liquidity, or convert it 1:1 into xTFY.

xTFY

The governance and reward token, obtained by converting TFY (1:1). Must be staked to unlock voting power and earn rebase rewards (protocol revenue + exit penalties). Exit back to TFY via a 180-day vest or instantly with a 50% penalty (distributed to stakers).

o33

A liquid staking token minted from xTFY. Offers passive, auto-compounding rewards (emissions + fees) by increasing the o33:xTFY ratio over time. The protocol automatically votes and manages rewards for o33 holders.

Exit penalties are redistributed to active stakers, creating aligned incentives and sustainable reward distribution.

Revenue-Based Deflationary Model

Beyond exit penalties, the protocol features a powerful community-controlled deflationary mechanism through revenue governance. All protocol revenue streams are subject to community voting on allocation between token burns (permanent supply reduction) and rebases (rewards distribution).

Revenue Sources Subject to Community Burns:

- Protocol Trading Fees - Fees from concentrated liquidity AMM and automated pool trading

- AI Services & x402 Fees - Revenue from integrated AI agents optimizing DeFi strategies, including x402 payments for credits and AI services

- Vault Management Fees - Revenue from automated liquidity management partnerships

- Future Revenue Streams - Cross-chain services, new DeFi products, and strategic partnerships

Token holders vote on proposals to determine what percentage of this revenue permanently burns TFY tokens versus distributing as enhanced staking rewards. This creates flexible deflationary pressure that adapts to market conditions and community preferences, with the potential for significant supply reduction as protocol revenue grows—especially as more AI agents and robotics tokens integrate with Thirdfy and generate additional fee volume.

Supply Tracking

To support transparency for listings, integrators, and users:

Elastic Emissions

Emissions stay elastic. Each epoch up to 2.88M TFY are available for distribution, and Jeff (the AI CEO) working through the voter decides how much is actually paid out. Any undistributed TFY can be burned or redirected by governance, keeping emissions aligned with protocol health.

Emissions Up

When performance supports it, the voter can release more of the available emissions to gauges to reward growth.

Emissions Down

When conditions soften, the voter can release less and direct the remainder to burns or other destinations to protect long-term sustainability.

Surplus & Burns

If not all available emissions are used, Jeff (the AI CEO) can leave the surplus undistributed so governance can burn it or redirect it, keeping inflation in check and aligning emissions with protocol health.

All emissions are directed to gauges through community governance. Parameters may be adjusted to maintain protocol sustainability and optimal economic balance.

Built for Balance

TFY's controlled supply expansion and elastic emissions create sustainable value accrual. The three-token system (TFY, xTFY, o33) provides flexible participation options while maintaining long-term protocol alignment through Thirdfy's proven o(3,3) mechanics.

Combined with community-driven burn mechanisms through revenue governance, the protocol maintains multiple deflationary pressures while ensuring adequate rewards for participants. The smart contract includes a technical maximum of 1.5B TFY tokens, though deflationary mechanisms and emission decay make this theoretical limit practically unreachable.

AI & Agent Economy Impact

Because Thirdfy is designed as AI- and robotics-first liquidity infrastructure on Base, the tokenomics are tightly coupled to agent activity. As more agents and robotics tokens use Thirdfy via x402 and MCP, they drive protocol revenue that can be redirected through governance into burns or rebases, deepening incentives and deflation for the entire agent and robotics liquidity hub.